3 Non Price Competition Strategies

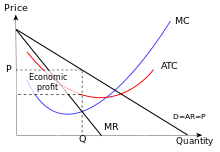

A model of imperfect contest in the short-run

Non-price competition is a marketing strategy "in which one firm tries to distinguish its product or service from competing products on the footing of attributes like design and workmanship".[1] It oftentimes occurs in imperfectly competitive markets because it exists between 2 or more producers that sell goods and services at the aforementioned prices just compete to increment their respective market shares through non-price measures such every bit marketing schemes and greater quality.[2] It is a course of contest that requires firms to focus on production differentiation instead of pricing strategies among competitors. Such differentiation measures assuasive for firms to distinguish themselves, and their products from competitors, may include, offering superb quality of service, extensive distribution, customer focus, or any sustainable competitive advantage other than price. When price controls are not present, the set of competitive equilibria naturally correspond to the state of natural outcomes in Hatfield and Milgrom's two-sided matching with contracts model.[3] [4]

It can exist assorted with price competition, which is where a company tries to distinguish its product or service from competing products on the basis of low price. Non-price competition typically involves promotional expenditures (such as advertising, selling staff, the locations convenience, sales promotions, coupons, special orders, or free gifts), marketing research, new product development, and brand management costs.

Businesses tin as well determine to compete against each other in the grade of not-price contest such every bit advertising and production development. Oligopolistic business normally do non appoint in toll competition as this usually leads to a decrease in the profit businesses tin can make in that specific market.

Airbnb logo: A well-known distinguished make

Not-price competition is a fundamental strategy in a growing number of marketplaces (oDesk, TaskRabbit, Fiverr, AirBnB, mechanical turk, etc) whose sellers offer their Service as a product, and where the price differences are virtually negligible when compared to other sellers of similar productized services on the same market place places. They tend to distinguish themselves in terms of quality, delivery time (speed), and customer satisfaction, among other things.

Market place structure [edit]

Although whatsoever company can utilise a non-cost contest strategy, it is most common amid oligopolies and monopolistic contest, considering firms can be extremely competitive. Firms will engage in non-price competition, in spite of the additional costs involved, because it is ordinarily more assisting than selling for a lower price, and avoids the risk of a toll state of war.

Kinked demand curve model

Oligopolistic competition [edit]

Non-cost contest often occurs in oligopoly, where few firms dominate the market. Due to the little or few firms in the market, these firms tend to compete in not-price measures to distinguish themselves. Such competition would exist otherwise known as quality competition where oligopolistic firms depend on their quality improvement intensities to survive.[5] In order to distinguish themselves well, These firms tin can compete in toll, but more oftentimes, oligopolistic firms engage in non-price contest because of their kinked demand curve. In the kinked need curve model, the firm will maximize its profits at Q,P where the marginal revenue (MR) is equal to the marginal cost (MC) of the house. Hence, a change in MC would not necessarily change the market place price, implying rather stable and pasty marketplace prices.

Long-run equilibrium of the business firm nether monopolistic competition

Monopolistic competition [edit]

Monopolistic market place structures too engage in non-price competition because they are not price takers. Due to having rather fixed marketplace prices, leading to inelastic demand, they engage in product differentiation. Monopolistic markets engage in non-price competition considering of how the marketplace is designed where the firm dominates the marketplace. In order to sustain in the market, they accept to innovate and improve on their product development to entreatment to consumers. The new merchandise theory suggests that the model of monopolistic contest plays a large role in explaining trade trends in trade patterns where product evolution drives product differentiation. Nether monopolistic competition, firms engage in not-toll competition to innovate and further boost their brand epitome.

Main types [edit]

There are two main branches of non-toll competition. This is where firms co-operative out to create new avenues for themselves to remain competitive in a market place where prices are rather sticky. Such streams of non-price competition include production differentiation and/or development and advertizement and/or promotion.

Product differentiation [edit]

Engaging in custom packaging to differentiate products from competitors

Production differentiation allows for a firm to institute its products from its competitors to win over a greater market share. The more different the products of rival firms are, the lower the cross effects between their markets with regards to both non-toll and price variables.[6] By offering a wide range of products, firms can non but achieve economies of telescopic, but likewise be able to aggrandize their market place base of operations. However, such product differentiation measures may result in significantly higher overhead costs.

Advertising and promotion [edit]

Instance of a promotional cloth to capture client attention: Marilyn Monroe and Tom Ewell in a promotional photograph for the moving picture The Seven Twelvemonth Itch, 1955.

Promotion can be considered an umbrella term to include all advertising, branding, public relations and packaging. This strategy includes all aspects of non-price strategies to continuously capture market place attention. Advertising is divided into 2 categories:

- Informative: This form of advertising includes informing consumers nearly product features, details descriptions.[2]

- Persuasive: This grade of advertising engages with the consumers on an emotional level. Such advertizing methods are highly linked to behavioural economics which takes advantage of the heuristics and bounded rationality of consumers when making decisions.

Advertising mediums can be designed specifically to meet with the expectations of consumers likewise as the size of the marketplace. Firms aim on reaching every bit high targets as possible past making apply of the network furnishings of advertising.[6]

Promotional means depend on a number of factors such as the nicheness of the marketplace, and allocated promotional budgets.

Examples [edit]

At that place are many ways of how firms can engage in non-price competition to increase their market place share and retain their customer base of operations. Examples are such similar loyalty programs, subsidized delivery, unique selling points, brand recognition, ethical and/or charitable concerns, after-sales service, positive feedback reviews, marketing campaigns and many more. The few of the more than of import and common examples of non-price competition are as follows.

Loyalty programs [edit]

Most firms offer out loyalty cards in order to capture market attending and retain customers. Loyalty cards are a form of differentiation where customers are given incentives to buy from that specific house.

AmazonPrime: paid subscription

Subsidized delivery [edit]

Big firms such as Amazon has been successful in offering AmazonPrime delivery in social club to provide free delivery for their customers, with a paid subscription. This would give customers an incentive to purchase more than because of the waived delivery fee. This works especially well for customers who are regular online shoppers. Supermarkets such every bit Tesco and Costco are offering commitment services worldwide as well, to cater for their international customer bases.

Unique selling points [edit]

Healthy food options catered to more health-conscious people

Firms with unique selling points are a result of focused differentiation considering products are customized to consumer preferences. For instance, nutrient companies now engage in promoting wellness foods which cater to healthy-living which has get a norm nowadays. Such products can have gluten-free options, sugar-free options and even depression-carb alternatives. Some unique selling points might as well be a result of practiced packaging that aim to capture consumer attention.

Accumulation of positive reviews [edit]

Many large companies rely on positive reviews from previous customers in club to gain positive feedback from others.[vii] Such methods are of import considering information technology gives other new consumers an anchor to base the quality of their products on, and creates a certain level of trust from the corporeality of positive feedback received.

Offering good subsequently-sales service [edit]

Logo of Apple tree: offer Apple Care to consumers

After-sales service is crucial for the reputation and brand loyalty of the firm. In order to retain customers, they would accept to provide great later-sales service then customers would be able to return and obtain the services they need. Examples are such similar Apple Intendance offer warranty and also proper services to repair the purchased devices.

Relationship with excess profits [edit]

Many economists wonder about the literature on non-cost competition whether positive profits accruing to the members of an oligopolistic group of firms, which may be pushed to goose egg by competitive price undercutting, can also be competed away past advertisement or other non-toll activities.[6] This question is specifically relevant to regulated industries without costless entry, or a dare arrangement, where the objective of the price regulation is to preserve turn a profit levels. This likewise comes to the question regarding successful or unsuccessful product differentiation among competitors. If advert costs are higher than the revenues of the firms, then information technology would lead to a waste of resources, resulting in negative profits.[viii]

The history of price competition has led to many believing that non-price competition is less intense equally compared to price contest. Formal models like those of Stigler(1968) show that the outcome depends on how the system parameters is valued.[half dozen]

Differences with price competition [edit]

The main difference between price competition and non-price contest would be the traditional case of which price competition exists in homogenous products where products are very difficult to be differentiated and can merely be produced in minimal forms. Such circumstances would consequence in firms competing with prices, leading to price wars. Price competition exists every bit a result of balancing between supply and demand for specified goods.[9]

Non-price competition engages in any other forms of non-price attributes of products or services tailored to capture as much market share every bit possible. Non-price competition revolve effectually competing qualitatively amongst products and services.

With relations to the need bend, toll competition implies that the business firm accepts its need curve and manipulates its toll to reach its goals. Not-price competition nevertheless, seeks to modify its demographics and shape of the demand curve by adapting and innovating.

Incentives [edit]

Price regulation [edit]

Price competition can exist completely absent in markets where the government fully sets the rates.[10] When there is no room for toll contest considering of stock-still market prices, firms resort to other non-toll alternatives to compete. Before deregulation in the belatedly 1970s and early 1980s, there were many industries in the The states where toll regulation was done in conjunction with not-price contest merely disguised equally price competition.[xi] The fixing of committee rates past the New York Exchange still allows brokerage houses to compete through non-price measures through offer advisory services regarding investments.[xi] Notwithstanding, elimination of cost competition through regulation does not necessarily event in non-price competition. In an initially unregulated industry, firms would exist able to choose optimal values for both price and non-price values.[eleven] Such an incentive would only happen when prices are regulated at a different equilibrium level.

Acts of collusion/cartel agreements [edit]

When firms within an manufacture engage in collusions or cartels to set up the market prices of their products, this rules out price competition among them. This would give each firm a fixed share of full output at the common price, therefore, showing a negatively-sloping need curve. Under a bunco, firms conspire against the consumer, only withal compete amongst each other in terms of quality or by advertising.[12] This is likewise to maintain their own branding by colluding on a set toll so their brands can be the distinguishing factor inside a branding competition.[thirteen]

Consider a situation where the cartel fixes a price and allows for contest in advertising. At that place would be 2 marginal costs: (i) Marginal price of production solitary (MCp) and (ii) Marginal cost of production + advertising (MCp+a). This leads to two possibilities: (1) Marginal cost (MCp+a) stays constant, (two) Marginal cost (MCp+a) falls. If marginal production cost (MCp) is constant, the marginal production cost+price of advertisement (MCp+a) will remain abiding too, under the conditions of increasing returns to advertising. On the other manus, if marginal production cost is ascent, then the rise must be equally offset by increasing returns to advertizing. In case (1), each firm will seek to expand output by increasing advertising efforts. In instance (two), firms will aggrandize until where (MCp+a) equals to the price.

Cost competition is believed past most economists to be more effective in increasing output and reducing profits as compared to non-toll competition. However, marginal costs of product do not rise as apace as marginal costs of advertizing, quality and other non-cost variables. Therefore, the more mutual and plausible view would be that the marginal not-price variable toll is larger than the marginal toll-reduction price, if the firm was an initial monopolist.[eleven]

Cases involving articulation ventures [edit]

When an industry is dominated by joint ventures, this makes joint venture partners obtain majority of the marketplace ability. This results in an irrelevant cost competition because it would not exist of utilise. An case would exist the Aspen Skiing Co. v. Aspen Highlands Skiing Corp., 472 U.S. 585 (1985) where these two firms owning these mountains formed a joint venture to offer consumers a elevator ticket adept at all four areas. Although they were not engaging in price competition, this joint venture was structured in a way where not-cost competition was fostered because the firms shared the revenue, and which immune consumers to still exist able to make their own choices in terms of the quality of the facilities offered by both partners.

Involvement of third-party payors [edit]

When consumers' bills are paid by third party entities, the consumer will decide on their consumption based on non-price measures, such equally quality, service or location. For instance, insurance coverage allow for buyers to engage in non-price decision making because they know that the insurance company will pay for them based on the insurance bundle they signed up for.

Antitrust Police force and non-price competition [edit]

With relations to the to a higher place section regarding incentives to engage in non-toll competition, these incentives pb to an unfair market structure that require the attention of competition regulators, specifically under Antitrust Laws.[x] For cases with price regulation, antitrust policies have managed to prevent various firms within the airline industry from merging so they would nevertheless engage in not-price competition.

For cases involving industry-wide joint ventures, courts have paid a close attending to only permit firms to engage in joint ventures if they are yet engaging in not-cost competition that protects the choices of consumers.

For cases involving third-political party payors, partial solutions where consumers are forced to engage in some cost comparisons where a threat of rate increases if too many claims are made.

Advantages and significance [edit]

Non-price competition is significant in the broad areas of economic science, concern and legal.

Economics [edit]

Every bit non-price competition consistently brings about product differentiation especially amidst monopolistic firms, it brings about a greater diverseness in production offerings, and can benefit and increment consumer utility through various ways. Not-price effects increasingly capture attention in the economic science domain of on the different dimensions and effects of non-price contest in the class of diverseness, quality and service.[14]

Business concern [edit]

Concern research confirms that firms rely highly on not-price strategies in competition. For example, in strategic management, areas of focus revolve around continuous innovation, synergism and long-term relationships that build sustainable businesses.[xiv] Similarly, in marketing, toll is not only the only factor that affects the firm. Other areas need to complement the prices set past firms in social club to maintain market place presence. These areas may include the 4 P's: Product, Promotion, Place and Price.

Law/legal [edit]

The being of not-price contest call upon the attention of antitrust law regulators in order to maintain fair competition amidst firms. A significant effect in the Continental Tin litigation was how a relevant product market should exist known for reviewing visitor mergers.[14]

Other advantages [edit]

- Innovation within the companies and industry: sales tactics, social media posts, virtual/technological advertisements, direct sales

- Quality assurance and improvement

- Brand establishment and reputation

- Economies of scope: offering products and services to various demographics.

- Healthier competition among competitors where they go beyond their status quo to reach competitive advantage within the industry.

- Widening consumer choices: they get to select based on non-toll attributes of products.

- Opens up avenues to unlike industries every bit more cooperation is needed within industries to introduce.

Disadvantages [edit]

- Fourth dimension-lapse: customers take fourth dimension to observe the changes within the industry.[fifteen]

- May incur boosted costs to firms engaging in not-price competition (advertising, marketing, etc.)

- Greater enquiry and development needed.

- Data asymmetry amidst customers and competitors.

- Moral take chances: consumers are unsure of which firm offers truly better quality products.

- Might pb to wasteful rent-seeking: If industry output does not increment, advertising is considered unambiguously to exist wasteful.[viii]

Run into besides [edit]

- Contest Law

- Imperfect competition

- Monopoly

- Oligopoly

- Toll competition

- Product differentiation

References [edit]

- ^ McConnell, Campbell R. (2002). Economics : principles, problems, and policies. Brue, Stanley L., 1945- (15th ed.). Boston, Mass.: McGraw-Loma. ISBN0-07-234036-3. OCLC 47074801.

- ^ A dictionary of business concern and direction. Police, Jonathan (Sixth ed.). Oxford. 2016. ISBN978-0-nineteen-176527-8. OCLC 944122322.

{{cite book}}: CS1 maint: others (link) - ^ Hatfield, John William; Kojima, Fuhito (2008). "Matching with Contracts: Comment". The American Economic Review. 98 (3): 1189–1194. doi:10.1257/aer.98.3.1189. ISSN 0002-8282. JSTOR 29730113.

- ^ [ane]

- ^ Moghadam, Hamed Markazi (2020-04-01). "Price and not-cost contest in an oligopoly: an analysis of relative payoff maximizers". Journal of Evolutionary Economics. 30 (two): 507–521. doi:x.1007/s00191-019-00653-8. hdl:10419/119460. ISSN 1432-1386. S2CID 214032844.

- ^ a b c d Lancaster, K. J. (2016), "Not-price Competition", The New Palgrave Dictionary of Economics, London: Palgrave Macmillan United kingdom of great britain and northern ireland, pp. 1–4, doi:ten.1057/978-ane-349-95121-5_1739-1, ISBN978-one-349-95121-5 , retrieved 2020-eleven-01

- ^ Pettinger, Tejvan. "Non-Price Competition". Economics Aid . Retrieved 2020-11-01 .

- ^ a b Boudreaux, Donald J. (1989). "Imperfectly Competitive Firms, Non-Price Contest, and Rent Seeking". Journal of Institutional and Theoretical Economics (JITE) / Zeitschrift für die gesamte Staatswissenschaft. 145 (four): 597–612. ISSN 0932-4569. JSTOR 40751243.

- ^ "Price and non-price competition". CEOpedia | Management online . Retrieved 2020-eleven-01 .

- ^ a b "Using the "Consumer Choice" Arroyo to Antitrust Law". Antitrust Police force Periodical. 74: 175–264 – via JSTOR.

- ^ a b c d Stigler, George J. (1968). "Price and Not-Price Competition". Journal of Political Economy. 76 (i): 149–154. doi:10.1086/259391. ISSN 0022-3808. JSTOR 1830736. S2CID 154265215.

- ^ "Price Fixing and Not-Price Competition". ResearchGate . Retrieved 2020-11-01 .

- ^ Wang, Huaqing; Gurnani, Haresh; Erkoc, Murat (2016). "Entry Deterrence of Capacitated Competition Using Price and Not-Price Strategies". Product and Operations Management. 25 (4): 719–735. doi:10.1111/poms.12500. ISSN 1937-5956.

- ^ a b c "Not-Price Furnishings of Mergers: Introduction and Overview | Request PDF". ResearchGate . Retrieved 2020-eleven-01 .

- ^ "What is Not-Price Competition? Definition and meaning". Market Business organization News . Retrieved 2020-eleven-01 .

Further reading [edit]

- Brue, Stanleye L., and McConnell, Campbell R. Economic science–Principles, Problems and Policies (15th edition). Boston: Irvin/McGraw-Loma, 2002.

3 Non Price Competition Strategies,

Source: https://en.wikipedia.org/wiki/Non-price_competition

Posted by: jonesclumand.blogspot.com

0 Response to "3 Non Price Competition Strategies"

Post a Comment